Introduction

Owning a luxury or sports car is a dream for many people. These cars are fast, stylish, and built with cutting-edge technology. But with high performance and high value comes greater risk. That’s why luxury and sports car insurance is different from regular car insurance.

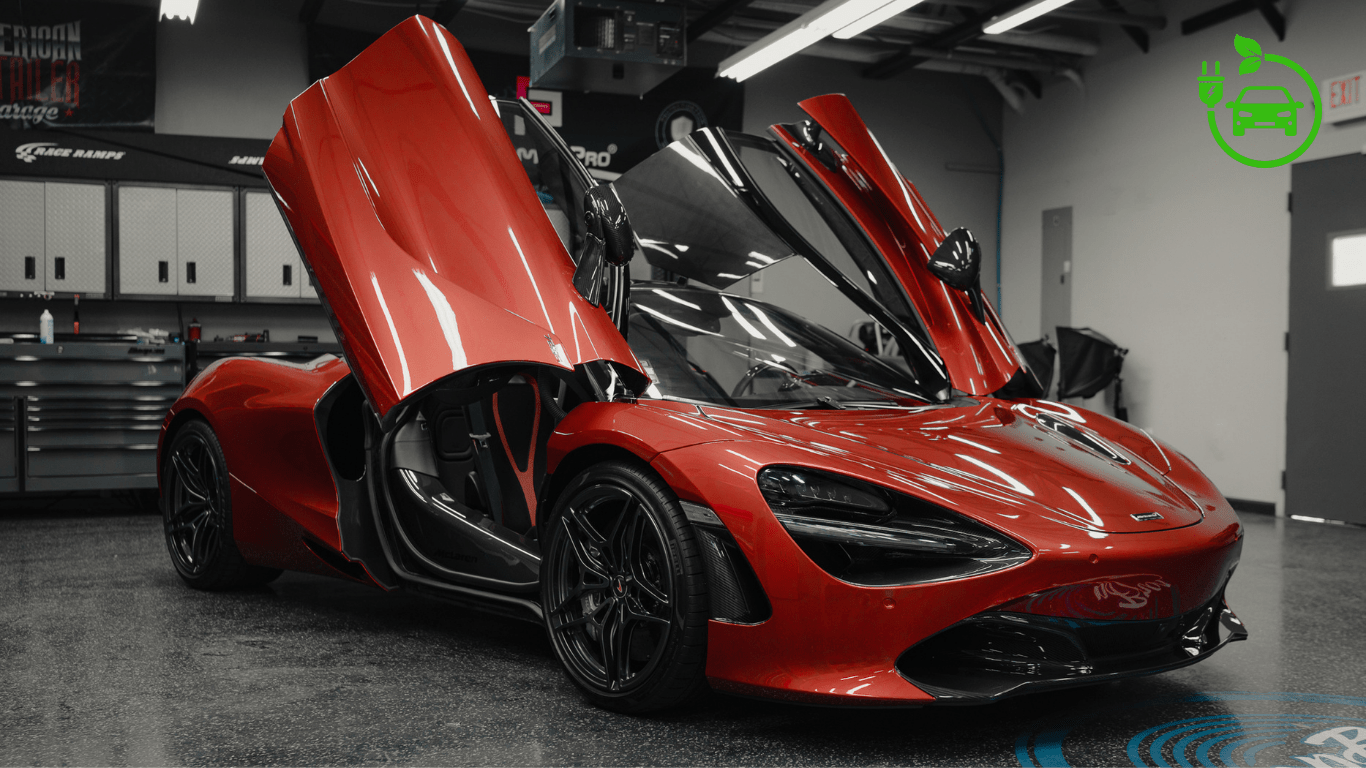

Whether you drive a Ferrari, Lamborghini, BMW M series, or Porsche, or even a high-end luxury SUV, you need the right protection. This article explains everything you should know about insuring luxury and sports cars in 2025 — what it covers, why it costs more, and how you can save money while still protecting your prized vehicle.

What Is Luxury & Sports Car Insurance?

Luxury and sports car insurance is a specialized type of coverage designed for high-value, high-performance vehicles. Unlike standard cars, luxury models and sports cars:

- Cost more to repair or replace.

- Have expensive parts and advanced technology.

- Are more attractive to thieves.

- Can reach higher speeds, which means greater accident risk.

Because of these factors, insurance companies create special policies that go beyond basic coverage.

Why Is Insurance More Expensive for Luxury & Sports Cars?

Several reasons explain the higher price of luxury and sports car insurance:

- High Vehicle Value

- A luxury car may cost $80,000–$500,000 or more, so replacing it after an accident is costly.

- Specialized Parts & Repairs

- Original parts and trained mechanics are expensive and not always available everywhere.

- Performance Risk

- Sports cars are built for speed. Higher speed = higher risk of severe accidents.

- Theft Risk

- Luxury cars are prime targets for thieves.

- Technology Features

- From adaptive cruise control to advanced sensors, repairing luxury tech costs more.

Types of Coverage You Need for Luxury & Sports Cars

When buying insurance for your luxury or sports car, it’s important to consider specialized coverage options:

- Agreed Value Coverage

- Unlike standard insurance, this ensures you’re paid the full agreed value of your car if it’s totaled, not just the depreciated amount.

- Comprehensive Coverage

- Protects against theft, fire, vandalism, or natural disasters.

- Collision Coverage

- Pays for damages to your car from accidents, regardless of fault.

- Uninsured Motorist Coverage

- Covers you if the other driver doesn’t have enough insurance.

- Exotic Car Insurance Add-ons

- Covers imported models, rare cars, or custom-built sports cars.

- Roadside Assistance for Luxury Cars

- Specialized towing for low-clearance cars like Lamborghinis.

Average Cost of Luxury & Sports Car Insurance

Insurance costs for luxury and sports cars are significantly higher than average cars.

- Luxury Sedans (e.g., Mercedes S-Class, BMW 7-Series): $3,000–$6,000 per year.

- Sports Cars (e.g., Porsche 911, Corvette, Audi R8): $4,000–$10,000 per year.

- Exotic Supercars (e.g., Ferrari, Lamborghini, McLaren): $7,000–$20,000+ per year.

Costs vary depending on:

- Driver’s age and driving record.

- Location (urban vs. rural).

- Car value and rarity.

- Security features installed.

Pros of Luxury & Sports Car Insurance

- Provides full value coverage instead of market depreciation.

- Protects against theft and vandalism, which are common risks.

- Specialized repair networks for premium vehicles.

- Some insurers include worldwide coverage for international travel.

Cons of Luxury & Sports Car Insurance

- Very expensive premiums compared to standard cars.

- Limited insurers offer coverage for exotic models.

- Repairs may take longer due to part availability.

- Some policies come with strict mileage limits.

How to Save Money on Luxury & Sports Car Insurance

Even though costs are high, smart drivers can reduce premiums:

- Install Advanced Security Systems

- GPS trackers, alarms, and immobilizers reduce theft risk.

- Use a Private Garage

- Insurers charge less if your car is stored securely.

- Choose Usage-Based Insurance

- Pay less if you drive only occasionally (common for luxury owners).

- Bundle Policies

- Combine car insurance with home or business insurance for discounts.

- Increase Deductibles

- Higher deductibles = lower monthly premiums.

- Defensive Driving Courses

- Completing certified courses can qualify you for lower rates.

- Shop Around

- Compare insurers who specialize in luxury and sports cars.

Future of Luxury & Sports Car Insurance

As we move into 2025 and beyond, insurance for luxury and sports cars is evolving:

- Telematics & AI Pricing: Insurers will track driving behavior and reward safe driving.

- Eco-Luxury Discounts: More luxury cars are hybrid or electric, which may lower costs.

- On-Demand Coverage: Pay-per-use policies will grow for rarely used supercars.

- Global Protection Plans: Coverage for owners who ship their cars internationally.

FAQs About Luxury & Sports Car Insurance

Q1. Is luxury car insurance always more expensive?

Yes, but prices vary depending on model, age, and driver profile.

Q2. Do I need agreed value coverage?

Yes, especially for exotic cars, so you’re paid the car’s full worth if it’s totaled.

Q3. Can I insure my sports car for occasional use only?

Yes, some insurers offer limited mileage policies that cost less.

Q4. Are modifications covered?

Not always. You need to disclose modifications for them to be insured.

Q5. Which companies insure luxury and sports cars?

Many global insurers offer specialized plans — but always compare quotes.

Conclusion

Luxury and sports cars require special attention when it comes to insurance. While premiums are higher, the right policy ensures you’re fully protected against theft, accidents, and costly repairs.

By choosing agreed value coverage, installing security features, and shopping for specialized policies, you can enjoy peace of mind while driving your dream car.

Luxury cars are not just vehicles — they are investments and lifestyle statements. Protecting them with the right insurance in 2025 is more important than ever.